MIB Cross Check℠

With MIB Cross Check℠, we enable insurers to compare millions of policyholder records with names in the Social Security Death Master File and comprehensive public and private death notices sources to identify deceased policyholders.

Timely and precise name matching

Our unique dual match technology helps solve the typical issues that slow down these searches, including inconsistent or insufficient data, typos, transposed records, or nicknames. The name-centric interface improves response accuracy and allows insurers to apply their own rules-based filters to results, improving the quality of the matches.

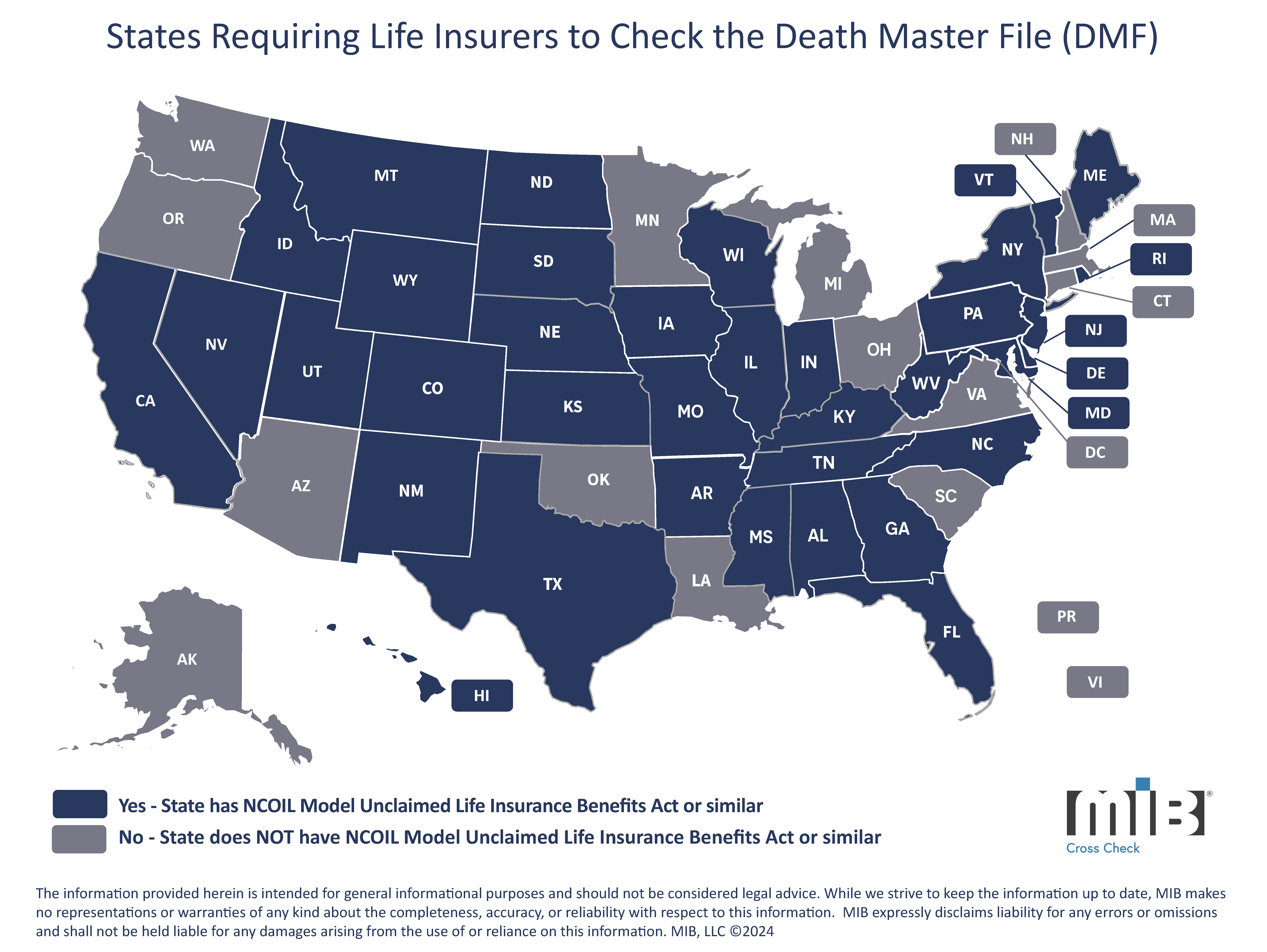

With this service, carriers are easily able to identify potential matches for deceased insureds and meet regulatory authority requirements in conjunction with the Unclaimed Life Insurance Benefits Act.

Comprehensive data set

MIB Cross Check℠ provides:

- Dual-match methodology provides sharp identification of deceased policyholders, both with and without SSN.

- Sophisticated business rules filter results by match quality.

- Side-by-side field match comparisons at the policy level so carriers can assess match quality and establish thresholds for further due diligence.

- Termination flags for policyholders who predeceased policy effective dates or died after policy cancellation dates.

- Exclusion of previously reported match records from future submissions.

Learn more about how MIB turns information into insights for the insurance industry

Contact Us