Save time and money with an MVR Indicator

By Whitney Barnes, New Business Development

March 22, 2021In today's challenging business environment, most life insurance carriers are looking for ways to cut costs and make underwriting processes more efficient, while still ensuring they identify and appropriately classify risk. Several of our members have asked to hear from other companies about their experiences in leveraging MIB services to address these challenges.

In response, I sat down with the Chief Underwriter from a member company who is taking advantage of MIB's discounted rate on our MVR Indicator service, a service we are offering in partnership with Verisk. She works for a top Midwestern insurance carrier with an annual MIB Checking Service volume of over 150K. She has been an Underwriter for 30+ years in the Life and Health space and has spent countless hours on product and process design and development including eApp and Instant Decision Methodology.

Whitney Barnes: What was the problem you were trying to solve when you were initially looking at the MVR Indicator service?

MIB Member: We needed a solution that would gather the information we need to make an underwriting decision faster and cheaper than our existing MVR Solution. We order MVRs as a requirement based on age and face amount, and the vast majority of them come back as blank or "clear." Getting a motor vehicle record takes about 3 days and costs about $15* on average so pursuing full reports was wasting a lot of time and costing a lot of money.

*Note: MVR costs may vary — $15 is based on this customer's specific experience and commentary.

Whitney Barnes: How did that problem affect your business?

MIB Member: It was stalling otherwise "ready to go business" from being issued. This resulted in a backlog in underwriting and new business, not to mention many phone calls from frustrated producers. We had underwriters saying, "I have all my requirements but I'm waiting on this MVR."

Whitney Barnes: What improvements or savings have you seen by using this service?

MIB Member: We saved time and money in the underwriting process by not having to off ramp the case out of the workflow to get the MVR ordered, received and routed for review. When our underwriters look at a new case, the MVR Indicator service has already processed along with the MIB Checking Service, and is ready for review. No waiting. We were careful to calibrate the tool to flag only those violations we consider to be of significance, so we know if the report comes back clear, we have eliminated anything adverse and we don't need to go that extra step of ordering the full MVR. The case can move through the workflow without a break in momentum. Since that is the vast majority of applications, we save a lot of time and money. If the report comes back as NOT clear, we then go ahead and order the full MVR.

We would much rather pay the greatly reduced MVR Indicator charge to MIB, which is 90% less than the average cost of a full MVR, to find out quickly that there is nothing adverse rather than taking the time and spending the money for a full MVR every time.

Whitney Barnes: What was the most challenging thing about implementation?

MIB Member: We didn't really experience any major challenges. Mainly just making sure we understood what the messages in the report meant. It didn't take long to acclimate.

Whitney Barnes: Why did you choose to sign up with Verisk through MIB?

MIB Member: It was a no brainer for us. I've been in the industry for 40 years and MIB is the gold standard of all things coming into underwriting. I just know by reputation and having worked with MIB for decades that they are going to ensure it is up to MIB standards and is accurate. I also know that they will provide support and someone knowledgeable to work with me as a liaison. So I don't have to worry, because when working with MIB, I'm working with an organization I know and I trust.

Save time and money with an MVR Indicator

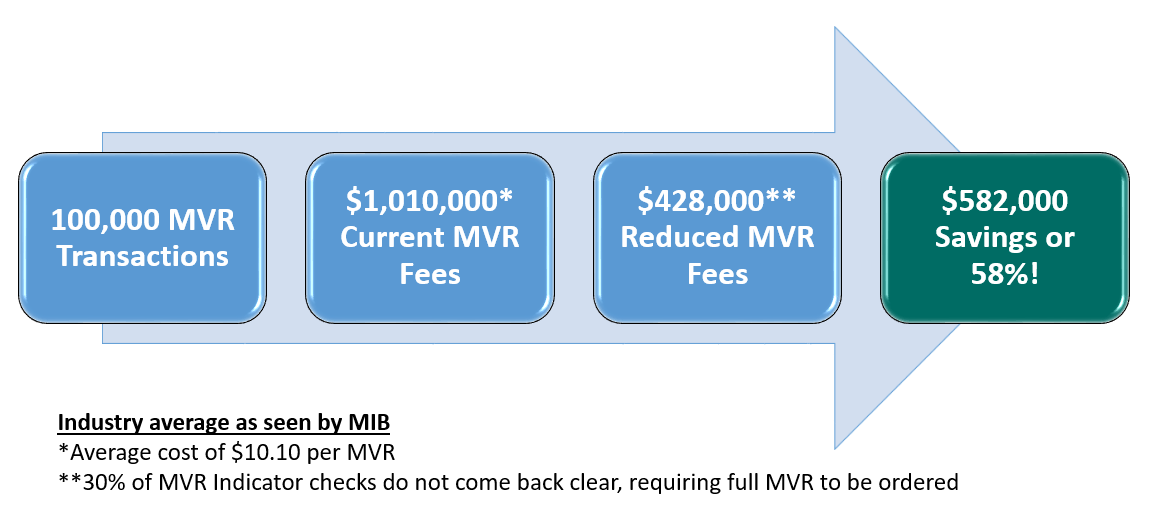

As described in my interview with this MIB Member, MVR Indicator flags applicants who have a motor vehicle record with violations of significance to underwriting, based on your criteria. MIB offers reduced rates to our members for this service through Verisk. A company that orders 100,000 MVRs a year can save around 58% when purchasing the MVR Indicator service through MIB. Of course, your actual savings will depend on your application volume, underwriting policies, your actual cost of an MVR and other related factors.

Interested in learning more?

For more information about MIB's member rates on the MVR Indicator from Verisk, please contact me at wbarnes@mib.com.

The MVR indicator is provided through MIB, Inc. to MIB members by the Insurance Information Exchange Unit (iiX) of ISO Claims Services, Inc., a Verisk business.

About Whitney Barnes

Whitney joined MIB in Oct of 2017 as the New Business Development & Sales associate. She has been in the life insurance industry for 17 years. Prior to joining MIB, she worked as the National Account Manager for OraSure Technologies selling oral fluid testing products in the life insurance space. Before that, she worked at ExamOne selling paramedical exams to the same market. She graduated from the University of Kansas with a Bachelor's of Science in Business. Whitney lives in Overland Park Kansas with her husband and 5 year old.

Copyright © 2023 MIB Group Holdings, Inc. All rights reserved.