April 13, 2022

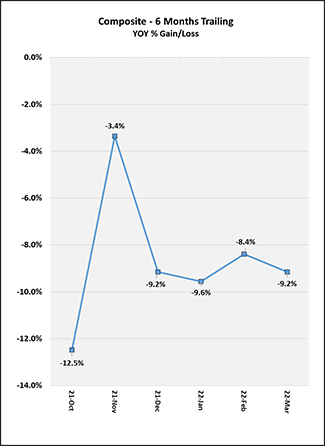

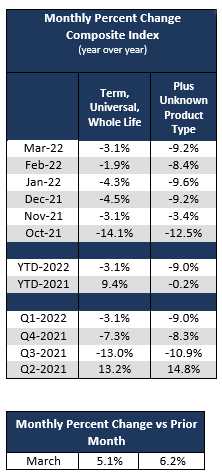

Canadian life insurance application activity declined in March with Year-over-Year (YOY) activity down -9.2%, when compared to March of 2021, and finishing Q1-2022 at -9.0% on a Year-to-Date (YTD) basis. The YOY comparison was impacted, in part, to a spike in activity seen in March of 2021. When examining Month-Over-Month (MOM) activity, March 2022 was up +6.2% compared to February 2022. Additionally, despite historical seasonal trends where Q1 activity is generally down compared to Q4, when comparing Q1-2022 to Q4-2021 activity was up +3.3%.

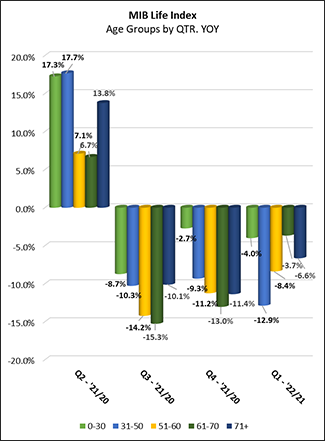

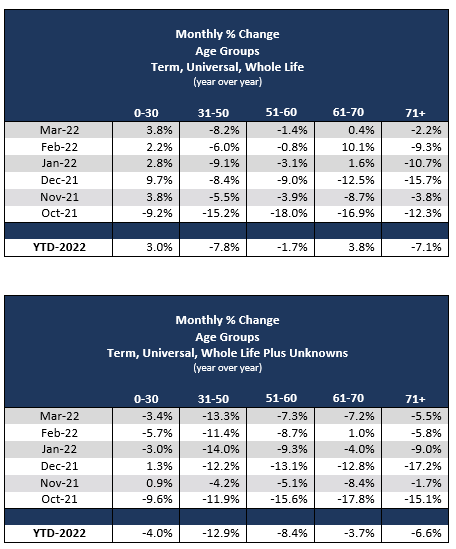

All ages groups showed YOY declines in March, in the double digits for ages 31-50. Q1-2022 saw similar patterns when compared to Q1-2021, with YTD activity declining across all age bands and double-digit declines for ages 31-50. However, on a MOM basis activity is trending up with March 2022 at growth over February 2022 across all age groups, in double digits for ages 0-30.

March saw YOY growth for face amounts over $500K up to and including $5M, flat activity for amounts over $5M and double-digit declines for face amounts up to and including $500K. When comparing quarterly activity by face amount, Q1-2022 was at growth compared to Q1-2021 for face amounts over $500K, in the double digits for face amounts over $1M up to and including $5M, but saw double-digit declines for face amounts up to and including $500K. When examining age bands for Q1-2022 compared to Q1-2021, ages 0-30 saw double-digit declines for face amounts up to and including $500K but double-digit growth for face amounts over $500K, in the triple digits (over 120%) for amount over $1M up to and including $2.5M. Age 31-50 saw declines for face amount up to and including $1M, in the double digits for face amounts up to and including $500K, and growth for face amounts over $1M, in the double digits for face amounts over $1M up to and including $5M. Ages 51-60 saw declines for face amounts up to and including $500K, in the double digits for amounts up to and including $250K, flat activity for amounts over $1M up to and including $2.5M, and double-digit growth for amounts over $500K up to and including $1M as well as amounts over $2.5M. Ages 61-70 saw double-digit declines for amounts up to and including $250k, double digit growth for amounts over $250K up to and including $1M, declines for amounts over $1M up to and including $2.5M, double-digit growth for amounts over $2.5M up to and including $5M and double-digit declines for amounts over $5M. Ages 71+ saw declines for face amounts up to and including $1M, in the double digits for amounts over $250K up to and including $1M, and growth for amounts over $1M, in the double digits for amounts over $1M up to and including $2.5M and amounts over $5M.

When examining activity patterns where a product type was submitted to MIB, Universal Life saw double-digit growth in March YOY of +17.8%, while Term Life was down -8.6%, and Whole Life was down -3.0%. Similarly, when comparing Q1-2022 to Q1-2021, Universal Life saw double-digit growth, while Whole Life and Term Life saw declines. When breaking down results comparing Q1-2022 to Q1-2021 by age, Universal Life saw growth for ages 0-70, in the double digits for ages 31-70, and double digit declines for ages 71+. Term Life saw declines for ages 0-60, in the double digits for ages 31-50, and growth for ages 61+, in the double digits for ages 71+. Whole Life saw double-digit growth for ages 0-30, and declines for ages 31+, in the double digits for ages 51+.

About 28% of total Life Index volume for Canada in Q1-2022 did not include a product type. We believe the vast majority of these submissions are for Life Insurance applications and have included them in the composite analysis presented in this report. Missing product type information has a significant impact on Canadian analysis. When looking solely at submissions identified as for Life Insurance products declines are more moderate, with activity down -3.1% YOY for Canada in March 2022 and down -3.1% YTD for Q1-2022 over Q1-2021.

NOTE: Due to frequent missing information regarding the applicant’s country of residence, effective January 2021 we are now identifying Canadian activity based on the company country.