December 6, 2023

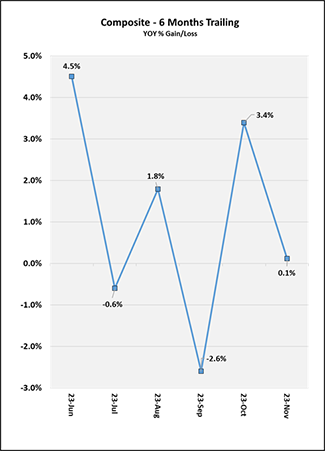

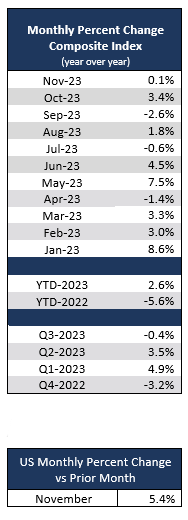

U.S. life insurance application activity was flat at +0.1% Year-over-Year (YOY) in November 2023 compared to November 2022, ending the month up +2.6% Year-to-Date (YTD). When comparing November 2023 to the same month in prior years, activity was flat at -0.1% YOY compared to 2021, up +2.8% compared to 2020, and up +4.1% compared to 2019. When taking a historical lookback on a YTD basis, activity through November 2023 was down -3.2% compared to 2021, flat at +0.9% compared to 2020, and up +4.4% compared to 2019. On a Month-over-Month basis (MOM), November was up +5.4% compared with October.

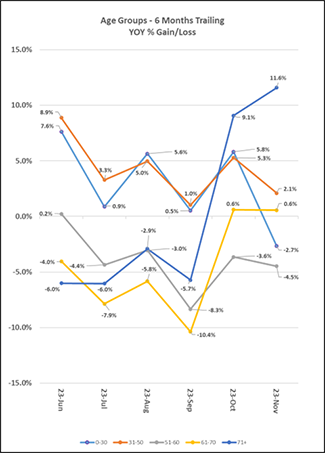

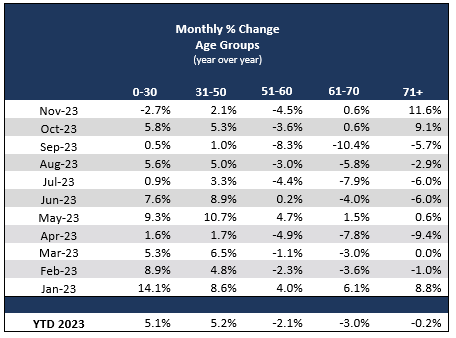

When looking at age bands, November saw a continuation of a pattern that began in October with ages 71+ leading in YOY growth. However, patterns for all other age bands have fluctuated with activity for ages 0-30 down -2.7%, ages 31-50 up +2.1%, ages 51-60 down -4.5%, ages 61-70 flat at +0.6%, and ages 71+ up +11.6%. However, on a YTD basis activity for ages 0-50 was at growth, ages 51-70 declined and ages 71+ is flat. Activity YTD for ages 0-30 was up +5.1%, ages 31-50 up +5.2%, ages 51-60 down -2.1%, ages 61-70 down -3.0% and ages 71+ flat at -0.2%.

When examining YOY activity by face amount, November 2023 saw flat activity for amounts up to and including $250K and growth for amounts over $250K, in the double digits for amounts over $500K. When including age bands, ages 0-30 saw flat activity for amounts up to and including $250K and growth for all other face amounts, in the double-digits for amounts over $1M. Ages 31-50 saw flat activity for amounts up to and including $250K, and growth for all other face amounts, in the double digits for amounts over $500K. Ages 51-60 saw declining activity for amounts up to and including $250K, and growth for all other face amounts, in the double digits for amounts over $1M. Ages 61-70 saw growth for all face amounts, in the double digits for amounts over $250K. Ages 71+ saw growth for amounts up to and including $5M, in the double digits for amounts up to and including $500K as well as amounts over $1M up to and including $2.5M, and saw double-digit declines for amounts over $5M.

November 2023 saw YOY flat activity for Term Life and growth for Universal Life and Whole Life. Specifically, Term Life was flat at +1.0%, Universal Life up +2.5%, and Whole Life up +6.6%, representing the second month that Whole Life led in YOY growth.

When examining activity by product type and age band, Term Life saw growth for ages 0-50, flat activity for ages 51-60, and declines for ages 61+, in the double-digits for ages 71+. Universal Life saw flat activity for ages 0-30, growth for ages 31-50, declines for ages 51-70, and double-digit growth for ages 71+. Whole Life saw flat activity for ages 0-30 and growth for all other age bands, in the double digits for ages 61+.

Subscribe to the Monthly Life Index Report

Provide us with your contact information and we will email you when the latest Life Index report is available.

2023 MIB Life Index Annual Report Now Available

Copyright © 2023 MIB Group Holdings, Inc. All rights reserved.